20+

Years of Investing

50+

Private Equity Sponsors

$1+

Billion Capital Invested

100+

Platform Companies

Mezzanine Capital

To traditional private equity firms to finance buyouts

One-Stop Junior Capital

To independent sponsors to finance buyouts

The Greyrock difference

Proven Lower-Middle Market Track Record

20-year history of investing through several cycles and situations.

Selective Underwriting

We remain selective to ensure ability to dig into the best opportunities as well as complex situations.

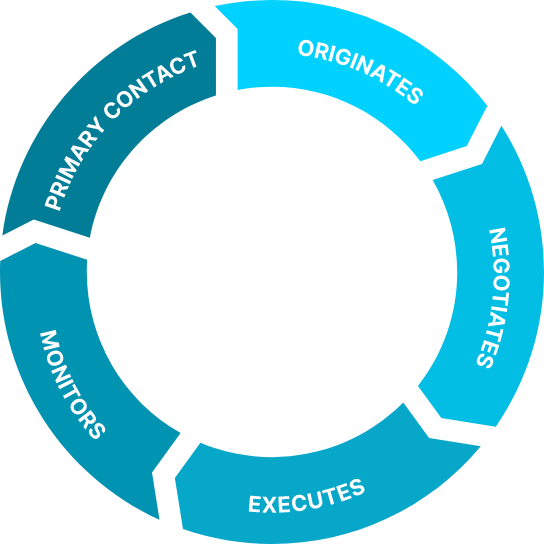

Small, Integrated Team

End-to-end deal relationship with portfolio companies.

The same deal lead who originated the deal remains the point person throughout the life of the investment